1st Feb 2011 Closing Market Updates 15:30

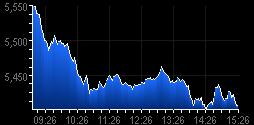

As written in earlier blog, Nifty tested the support of 5410. Nifty ended at 5403.10 with a fall of 102.80 points and Sensex ended 336.93 points to end at 17990.83

Indian markets continued to drop for the fifth day on Tuesday. At 2.40 p.m., the Sensex was trading down 300 points or 1.64% at 18,027.91 with 27 components falling. Meanwhile, the Nifty was trading lower by 97.40 points or 1.77% at 5,408.50 with 48 components falling.

The 30-share benchmark index, BSE Sensex opened with a gain of 97.42 points or 0.53% at 18,425.18, while the broad based NSE Nifty started with a rise of 31.40 points or 0.57%, at 5,537.30.

Sensex Movers

Reliance Industries contributed fall of 57.81 points in the Sensex. It was followed by I T C (37.73 points), I C I C I Bank (34.51 points), Larsen & Toubro (30.42 points) and Infosys Technologies (26.32 points).

However, Housing Development Finance Corporation contributed rise of 8.4 points in the Sensex. It was followed by Sterlite Industries (India) (1.16 points), Hindalco Industries (0.08 points), D L F (0.73 points) and Oil & Natural Gas Corporation (0.79 points).

Biggest gainers in the 30-share index:

Housing Development Finance Corporation (0.80%),

Sterlite Industries (India) (0.34%),

Hindalco Industries (0.02%).

Biggest losers in the Sensex.

Tata Motors (5.04%),

Jindal Steel & Power (4.70%),

Jaiprakash Associates (4.02%),

I T C (3.38%),

Reliance Communications (2.98%),

Reliance Industries (2.86%)

Mid & Small-cap SpaceThe BSE Mid and small caps outperformed their larger counterparts declining-1.52% and -1.28% respectively.

The major losers in the BSE Midcap were A B G Shipyard (2.31%), Alstom Projects India (1.43%), A I A Engineering (1.15%), Core Projects and Technologies (1.14%) and Aban Offshore (0.34%).

The major losers in the BSE Smallcap were Aarti Industries (3.1%), Action Construction Equipment (2.6%), Provogue (India) (2.4%), A B G Infralogistics (1.86%) and Abhishek Industries (0.28%).

Sectors in Limelight

The Realty index was at 2,157.35, down by 71.37 points or by 3.2%. The major losers were Housing Development and Infrastructure (3%), Indiabulls Real Estate (2.78%), Godrej Properties (2.09%), D L F (0.63%) and Anant Raj Industries (0.2%).

The FMCG index was at 3,274.36, down by 91.84 points or by 2.73%. The major losers were I T C (3.38%), Godrej Consumer Products (2.78%), Colgate-Palmolive (India) (2.03%), Hindustan Unilever (1.36%) and Dabur India (1.22%).

The Auto index was at 8,690.13, down by 204.45 points or by 2.3%. The major losers were Amtek Auto (7.96%), Ashok Leyland (3.73%), Exide Industries (2.02%), Bharat Forge (1.91%) and Bajaj Auto (0.27%).

The Oil & Gas index was at 9,270.45, down by 211.46 points or by 2.23%. The major losers were Bharat Petroleum Corporation (5.33%), Hindustan Petroleum Corporation (3.42%), G A I L (India) (2.77%), Indian Oil Corporation (2.69%) and Oil India (0.86%).

Market Breadth

Market breadth was negative with 972 advances against 1,874 declines.

Value and Volume Toppers

State Bank Of India topped the value chart on the BSE with a turnover of Rs. 1,742.24 million. It was followed by C.Mahendra Exports (Rs. 1,524.29 million), Reliance Industries (Rs. 1,501.19 million) and Tata Steel (Rs. 1,124.53 million).

The volume chart was led by Unitech with trades of over 11.71 million shares. It was followed by C.Mahendra Exports (9.36 million), Delta Corp (8.91 million) and Cals Refineries (8.09 million).

As written in earlier blog, Nifty tested the support of 5410. Nifty ended at 5403.10 with a fall of 102.80 points and Sensex ended 336.93 points to end at 17990.83

Indian markets continued to drop for the fifth day on Tuesday. At 2.40 p.m., the Sensex was trading down 300 points or 1.64% at 18,027.91 with 27 components falling. Meanwhile, the Nifty was trading lower by 97.40 points or 1.77% at 5,408.50 with 48 components falling.

The 30-share benchmark index, BSE Sensex opened with a gain of 97.42 points or 0.53% at 18,425.18, while the broad based NSE Nifty started with a rise of 31.40 points or 0.57%, at 5,537.30.

Sensex Movers

Reliance Industries contributed fall of 57.81 points in the Sensex. It was followed by I T C (37.73 points), I C I C I Bank (34.51 points), Larsen & Toubro (30.42 points) and Infosys Technologies (26.32 points).

However, Housing Development Finance Corporation contributed rise of 8.4 points in the Sensex. It was followed by Sterlite Industries (India) (1.16 points), Hindalco Industries (0.08 points), D L F (0.73 points) and Oil & Natural Gas Corporation (0.79 points).

Biggest gainers in the 30-share index:

Housing Development Finance Corporation (0.80%),

Sterlite Industries (India) (0.34%),

Hindalco Industries (0.02%).

Biggest losers in the Sensex.

Tata Motors (5.04%),

Jindal Steel & Power (4.70%),

Jaiprakash Associates (4.02%),

I T C (3.38%),

Reliance Communications (2.98%),

Reliance Industries (2.86%)

Mid & Small-cap SpaceThe BSE Mid and small caps outperformed their larger counterparts declining-1.52% and -1.28% respectively.

The major losers in the BSE Midcap were A B G Shipyard (2.31%), Alstom Projects India (1.43%), A I A Engineering (1.15%), Core Projects and Technologies (1.14%) and Aban Offshore (0.34%).

The major losers in the BSE Smallcap were Aarti Industries (3.1%), Action Construction Equipment (2.6%), Provogue (India) (2.4%), A B G Infralogistics (1.86%) and Abhishek Industries (0.28%).

Sectors in Limelight

The Realty index was at 2,157.35, down by 71.37 points or by 3.2%. The major losers were Housing Development and Infrastructure (3%), Indiabulls Real Estate (2.78%), Godrej Properties (2.09%), D L F (0.63%) and Anant Raj Industries (0.2%).

The FMCG index was at 3,274.36, down by 91.84 points or by 2.73%. The major losers were I T C (3.38%), Godrej Consumer Products (2.78%), Colgate-Palmolive (India) (2.03%), Hindustan Unilever (1.36%) and Dabur India (1.22%).

The Auto index was at 8,690.13, down by 204.45 points or by 2.3%. The major losers were Amtek Auto (7.96%), Ashok Leyland (3.73%), Exide Industries (2.02%), Bharat Forge (1.91%) and Bajaj Auto (0.27%).

The Oil & Gas index was at 9,270.45, down by 211.46 points or by 2.23%. The major losers were Bharat Petroleum Corporation (5.33%), Hindustan Petroleum Corporation (3.42%), G A I L (India) (2.77%), Indian Oil Corporation (2.69%) and Oil India (0.86%).

Market Breadth

Market breadth was negative with 972 advances against 1,874 declines.

Value and Volume Toppers

State Bank Of India topped the value chart on the BSE with a turnover of Rs. 1,742.24 million. It was followed by C.Mahendra Exports (Rs. 1,524.29 million), Reliance Industries (Rs. 1,501.19 million) and Tata Steel (Rs. 1,124.53 million).

The volume chart was led by Unitech with trades of over 11.71 million shares. It was followed by C.Mahendra Exports (9.36 million), Delta Corp (8.91 million) and Cals Refineries (8.09 million).

Following such blogs helps in gaining a quick overview of stock market performance. Traders willing to earn good from market should always learn market updates timely. If you lack in sufficient market knowledge then you can consider mcx tips of experts with very good market knowledge.

ReplyDelete