31st March Market Closing Updates:

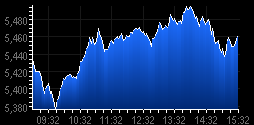

Indian markets continued to gain for the eighth day on Thursday

The 30-share benchmark index, BSE Sensex opened with a gain of 49.57 points or 0.26% at 19,339.75, while the broad based NSE Nifty started with a rise of 15.40 points or 0.27%, at 5,803.05.

Sensex Movers

I:nfosys Technologies contributed rise of 29.46 points in the Sensex. It was followed by Tata Consultancy Services (20.94 points), I T C (15.97 points), Reliance Industries (14.84 points) and Larsen & Toubro (13.23 points).

However, State Bank Of India contributed fall of 22.02 points in the Sensex. It was followed by H D F C Bank (11.97 points), I C I C I Bank (10.56 points), Bharti Airtel (10.48 points) and Tata Motors (9.23 points).

Major gainers in the 30-share index:

Hero Honda Motors (2.71%),

Tata Consultancy Services (2.48%),

Hindustan Unilever (1.73%),

Bajaj Auto (1.58%),

Oil & Natural Gas Corporation (1.58%),

Infosys Technologies (1.48%).

The biggest losers in the Sensex:

Reliance Communications (2.91%),

Cipla (2.64%),

Jaiprakash Associates (2.50%),

State Bank Of India (2.21%),

Mahindra & Mahindra (1.84%),

Bharti Airtel (1.81%)

Mid & Small-cap Space

The BSE Mid and small caps underperformed their larger counterparts declining -0.46% and -0.14% respectively.

The major losers in the BSE Midcap were Alstom Projects India (3.07%), Aban Offshore (1.34%), A B G Shipyard (0.63%), A I A Engineering (0.45%) and A2Z Maintenance & Engineering Services (0.36%).

The major losers in the BSE Smallcap were A K Capital Services (3.48%), Abhishek Industries (2.02%), Reliance MediaWorks (1.36%), Action Construction Equipment (0.91%) and Adhunik Metaliks (0.81%).

Sectors in Limelight

The IT index was at 6,510.26, up by 85.28 points or by 1.33%. The major gainers were Tata Consultancy Services (2.48%), Infosys Technologies (1.48%), Tech Mahindra (0.17%) and Patni Computer Systems (0.02%).

The FMCG index was at 3,576.14, up by 39.06 points or by 1.10%. The major gainers were Hindustan Unilever (1.73%), I T C (1.29%), Godrej Consumer Products (1.23%), United Breweries (0.94%) and Dabur India (0.21%).

The Capital Goods index was at 13,365.94, up by 110.80 points or by 0.84%. The major gainers were Havell`S India (2.8%), Larsen & Toubro (1.17%), Bharat Heavy Electricals (0.87%), A B B (0.59%) and BEML (0.31%).

On the other hand, the Bankex index was at 13,248.04, down by 145.28 points or by 1.08%. The major losers were Federal Bank (3.35%), Bank Of Baroda (2.33%), Bank Of India (1.75%), H D F C Bank (1.11%) and I C I C I Bank (0.65%).

Market Breadth

Market breadth was negative with 1,230 advances against 1,489 declines.

Value and Volume Toppers

State Bank Of India topped the value chart on the BSE with a turnover of Rs. 930.18 million. It was followed by Titan Industries (Rs. 540.53 million), Acropetal Technologies (Rs. 441.96 million) and Reliance Industries (Rs. 429.07 million).

The volume chart was led by K Sera Sera with trades of over 14.81 million shares. It was followed by Acropetal Technologies (7.16 million), Smartlink Network Systems (5.46 million) and Cals Refineries (3.91 million).

Indian markets continued to gain for the eighth day on Thursday

The 30-share benchmark index, BSE Sensex opened with a gain of 49.57 points or 0.26% at 19,339.75, while the broad based NSE Nifty started with a rise of 15.40 points or 0.27%, at 5,803.05.

Sensex Movers

I:nfosys Technologies contributed rise of 29.46 points in the Sensex. It was followed by Tata Consultancy Services (20.94 points), I T C (15.97 points), Reliance Industries (14.84 points) and Larsen & Toubro (13.23 points).

However, State Bank Of India contributed fall of 22.02 points in the Sensex. It was followed by H D F C Bank (11.97 points), I C I C I Bank (10.56 points), Bharti Airtel (10.48 points) and Tata Motors (9.23 points).

Major gainers in the 30-share index:

Hero Honda Motors (2.71%),

Tata Consultancy Services (2.48%),

Hindustan Unilever (1.73%),

Bajaj Auto (1.58%),

Oil & Natural Gas Corporation (1.58%),

Infosys Technologies (1.48%).

The biggest losers in the Sensex:

Reliance Communications (2.91%),

Cipla (2.64%),

Jaiprakash Associates (2.50%),

State Bank Of India (2.21%),

Mahindra & Mahindra (1.84%),

Bharti Airtel (1.81%)

Mid & Small-cap Space

The BSE Mid and small caps underperformed their larger counterparts declining -0.46% and -0.14% respectively.

The major losers in the BSE Midcap were Alstom Projects India (3.07%), Aban Offshore (1.34%), A B G Shipyard (0.63%), A I A Engineering (0.45%) and A2Z Maintenance & Engineering Services (0.36%).

The major losers in the BSE Smallcap were A K Capital Services (3.48%), Abhishek Industries (2.02%), Reliance MediaWorks (1.36%), Action Construction Equipment (0.91%) and Adhunik Metaliks (0.81%).

Sectors in Limelight

The IT index was at 6,510.26, up by 85.28 points or by 1.33%. The major gainers were Tata Consultancy Services (2.48%), Infosys Technologies (1.48%), Tech Mahindra (0.17%) and Patni Computer Systems (0.02%).

The FMCG index was at 3,576.14, up by 39.06 points or by 1.10%. The major gainers were Hindustan Unilever (1.73%), I T C (1.29%), Godrej Consumer Products (1.23%), United Breweries (0.94%) and Dabur India (0.21%).

The Capital Goods index was at 13,365.94, up by 110.80 points or by 0.84%. The major gainers were Havell`S India (2.8%), Larsen & Toubro (1.17%), Bharat Heavy Electricals (0.87%), A B B (0.59%) and BEML (0.31%).

On the other hand, the Bankex index was at 13,248.04, down by 145.28 points or by 1.08%. The major losers were Federal Bank (3.35%), Bank Of Baroda (2.33%), Bank Of India (1.75%), H D F C Bank (1.11%) and I C I C I Bank (0.65%).

Market Breadth

Market breadth was negative with 1,230 advances against 1,489 declines.

Value and Volume Toppers

State Bank Of India topped the value chart on the BSE with a turnover of Rs. 930.18 million. It was followed by Titan Industries (Rs. 540.53 million), Acropetal Technologies (Rs. 441.96 million) and Reliance Industries (Rs. 429.07 million).

The volume chart was led by K Sera Sera with trades of over 14.81 million shares. It was followed by Acropetal Technologies (7.16 million), Smartlink Network Systems (5.46 million) and Cals Refineries (3.91 million).